The Association of Consumer Support Organisations (ACSO), the trade body for companies that help consumers in the civil justice system, says that fixed costs for certain legal services in England & Wales are in need of immediate review.

It has urged the CPRC (Civil Procedure Rules Committee) and the CJC (Civil Justice Council), as part of its ongoing costs consultation, to review the current level of fixed recoverable costs (FRC) for personal injury (PI) cases, as contained in Part 45 of the Civil Procedure Rules (CPR).

Research by ACSO found that many FRC for PI have not been uprated since July 2013 and that there is presently no mechanism to ensure their review. Matthew Maxwell Scott, ACSO's executive director, said that the entire process for dealing with adjustments in fixed costs, rates, fees, damages and discount rates is arbitrary and needs a complete overhaul if consumers are not to lose out from an unavailability of legal support.

He said: "There is an elephant in the room when it comes to inflation and the FRC regime. While PI costs have remained static for almost a decade, elsewhere ministers have committed to a review of the discount rate every five years."

Maxwell Scott said the criteria for uplifts also vary. "The judicial college guidelines for general damages has climbed in line with the Retail Price Index, yet the Ministry of Justice intends to update the extended FRC proposed matrix at the lower Services Producer Price Index rate. Why are officials using different indices?"

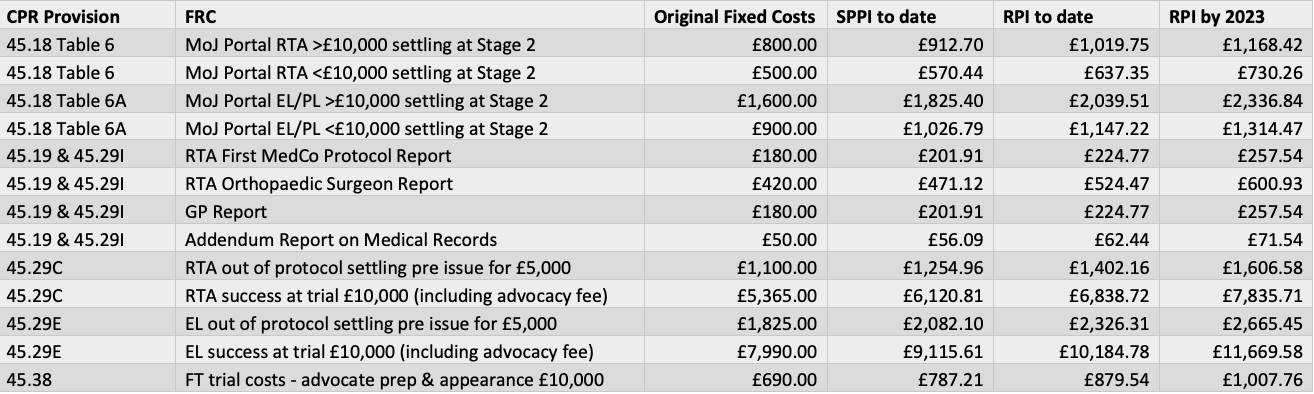

Tables produced by ACSO (i) show that, for example, fixed costs for a Ministry if Justice (MoJ) portal road-traffic accident case settling at more than £10K were originally set at £800 in 2013. Allowing for an inflationary increase at RPI, those cosets should now be just under £1,020, a difference of more than £200, and by the end of 2023 the difference could be closer to £400.

For an initial medical report in a similar injury case, the fixed costs were set at £180 in 2014. Including inflation at RPI, the report should have costs of just under £225, nearly £45 more than the current rate. By the end of 2023, the shortfall could be as much as £80 per report.

Maxwell Scott said: "The freezing of rates for so long means dramatic real-terms cuts for claimants, their representatives and for medical experts and there has been no explanation for this."

Other examples of inconsistency include:

Claims Track Limits - pre-31 May 2021, road traffic accident (RTA) claims valued at over £1,000 were classed as fast-track cases and the legal representative was entitled to FRC. Now, many of those claims under £5,000 reside in the small-claims track and are not subject to any recoverable legal costs. Similarly, the EL/PL small-claims limit was shifted from £1,000 to £1,500 on 6 April 2022. Despite these changes, FRC matrix tables remain largely untouched.

Guideline Hourly Rates (GHR) - set on 19 April 2010, GHR for Solicitors in England and Wales remained unchanged until 1 October 2021, when the Civil Justice Council (CJC) recommended that inflation ought to be applied to bring rates in line with the reality of a decade of economic forces. The CJC considered the issue of regular, even annual, updates to GHR for inflation and saw merit in the idea, but concluded that this should be guided by later reviews on PI FRC and Intellectual Property Enterprise Court capped costs.

The effect of an increase in GHR is, in essence, an acknowledgement that the recoverable costs for legal staff (qualified and non-qualified) across the sector is increasing because of economic forces. The current cost-of-living crisis will undoubtedly factor into considerations during the ongoing re-review of GHR being undertaken by the CJC. This process of adjustment and readjustment is entirely at odds with a failure to uplift FRC for fast-track cases.

Judicial College Guidelines (JCG) - the latest edition of the JCG (16th edition) was introduced in April 2022, more than two years since the last update. In very general terms, guideline figures increased by a percentage close to the RPI increase for the period, at an average of 6.56%. JCG are usually updated approximately every two years and have been uprated each time. Damages levels tie directly into FRC calculations, a relationship that the disjoined approach to adjustment processes fails adequately to manage.

Proposed extended FRC uplifts planned before implementation - adjusted in 2017, it has been clear in the MoJ consultation papers and subsequent commentary that there is an intention to uplift the proposed matrix for FRC in the new extended fast track for SPPI since that date. It is therefore acknowledged that a further update is necessary to protect the intended effect of the proposed 2017 figures, but not for those that were largely implemented in 2013 and 2014.

"Fixed costs are prescribed by law and are thus not open to challenge by the paying party, making their regular review all the more important in the context of safeguarding access to justice," said Maxwell Scott.

"The government has already slashed the fees paid to lawyers representing injured people; added to this a failure to review FRC in a sensible manner risks many law firms beginning to refuse cases because they are uneconomic or even leaving the market altogether."

"In the alternative, many predict a substantial increase in damages deductions for solicitors' own client costs, possibly up to 40 or 50 per cent, in order to make ends meet."

He said: "Should this continue, consumers will either be cut off from the justice system entirely or will face a compensation crisis where damages recovered fail to adequately meet their needs due to increasing costs obligations placed on their own solicitor.

Maxwell Scott concluded: "The costs regime has been managed in a piecemeal manner for too long, and it is high time it was overhauled."